Imagine a monetary system so mighty it fuels oil deals in the Middle East and coffee trades in East Africa. This financial powerhouse would be none other than the US dollar, the greenback that’s ruled the global economy for over a century. Born during the scrappy days of a fledgling America, the US dollar rose through wars, clever deals as well as sheer economic heft to become the world’s go-to currency. Yet in 2025, with BRICS nations pushing back in rebellion and economic tremors like a US credit downgrade shaking trust, the US dollar faces a new stormy horizon. Let’s trace the dollar’s epic climb from colonial chaos to global money monarch and explore why its crown could slip if mishandled.

Birth of a New Currency

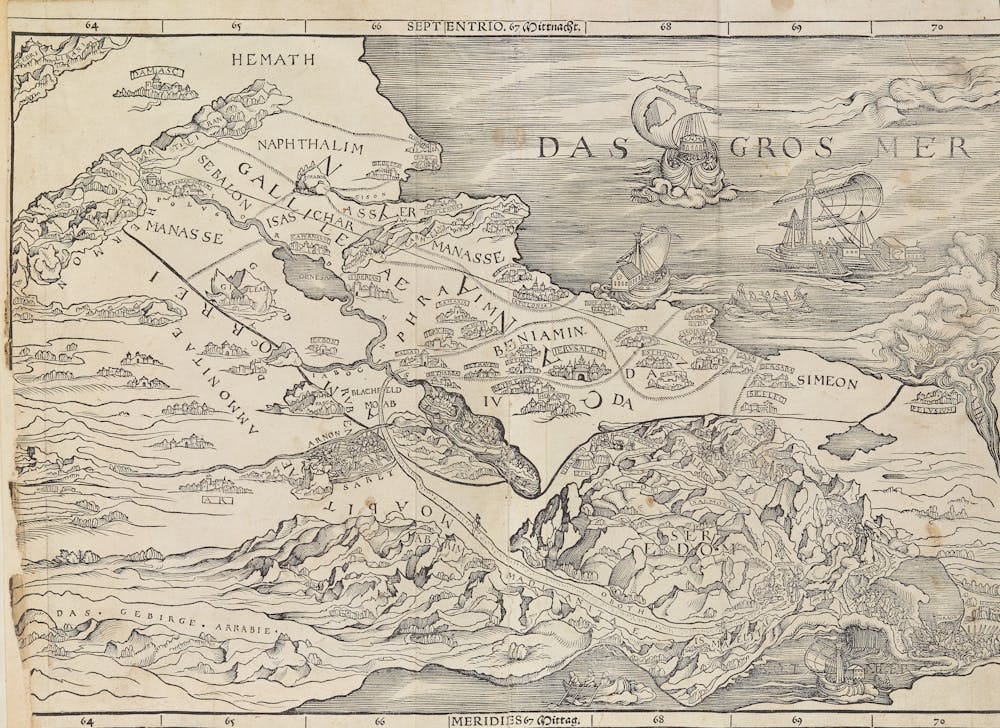

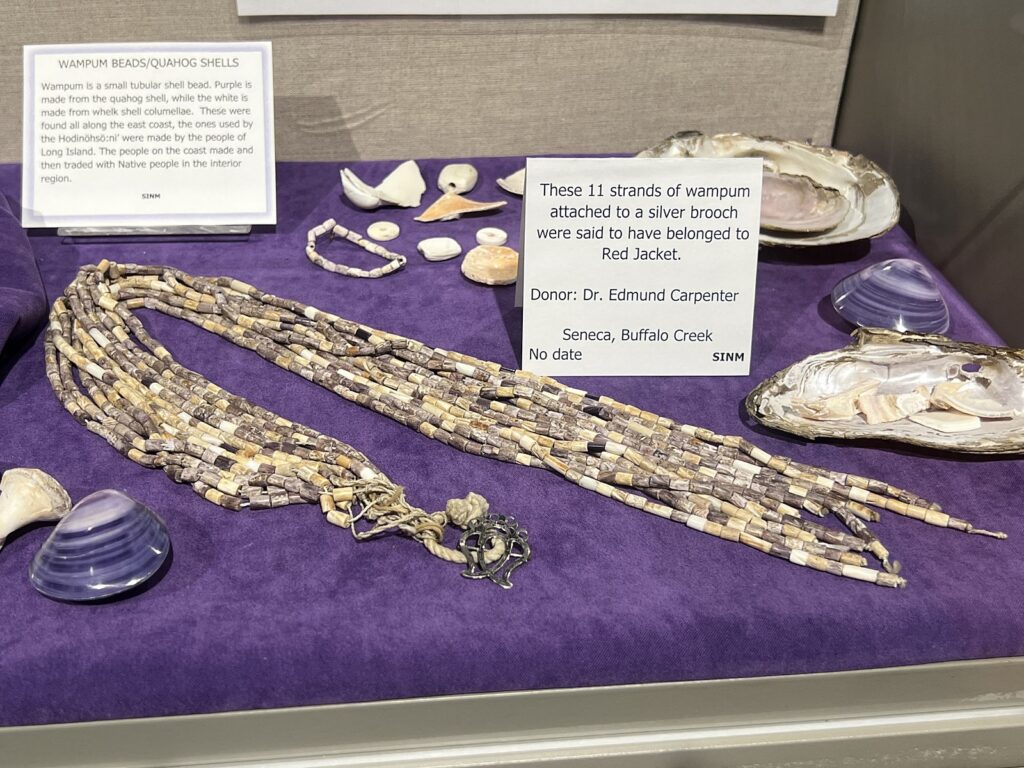

The dollar’s story starts in the 1700s, when America was a patchwork of currencies ranging from Spanish pesos and British shillings to even wampum beads swapped in markets. The 1792 Coinage Act eventually birthed the dollar, pegged to silver and modeled on Spanish coins. The US dollar progressed further when one of America’s Founding Fathers and the first US secretary of the treasury Alexander Hamilton steered a national bank to stabilize it.

Early days of finance were rough: Revolutionary War “Continental dollars” crashed so hard they became a joke—“not worth a Continental” was the negative idiom of the day. However, by the 19th century, the dollar gained traction as the US economy grew, but the British pound still ruled global trade. The Civil War brought greenbacks—paper money not backed by metal—sparking debates over trust that lingered into the 1900s. Pretty wild, huh? Just imagine a young nation’s currency finding its legs and growing in strength, but it wasn’t yet a global player.

The US Dollar’s Road to Power

From chaos comes opportunity, for the 20th century turned the tide. World War I made the US a financial powerhouse, lending gold to war-torn Europe and boosting the dollar’s cred. By World War II, with Europe in shambles, the 1944 Bretton Woods Agreement crowned the dollar as king: 44 nations pegged their currencies to it, tied to gold at $35 an ounce. The US held nearly 70% of global gold reserves, making the dollar the backbone of trade and savings. Then, when US President Nixon cut the gold link in 1971—so-called the “Nixon Shock”—the dollar could’ve tanked. Instead, a 1974 deal with Saudi Arabia made oil trades dollar-only, birthing the petrodollar system.

Every oil-hungry nation had to hoard greenbacks which further cemented the US dollar’s reign. By 1980, the US dollar powered 80% of global transactions whilst being backed by America’s massive economy; nearly half global GDP in the 1960s.

Fast forward to 2025, the dollar still dominates, holding 58% of global foreign exchange reserves and driving 96% of trade in the Americas… but trouble’s brewing.

The Rise of New Global Foes

BRICS—made up of Brazil, Russia, India, China, South Africa, plus new joiners like Saudi Arabia and Iran—are gunning for change. Fed up with US sanctions (such as those crippling Russia post-2022 Ukraine invasion) these nations are pushing for de-dollarization. China’s yuan hit 3% of global trade in 2024, up from 1% a decade ago, with Russia and India trading oil in rupees to sidestep dollar controls. The BRICS New Development Bank now offers loans in local currencies, and whispers of a BRICS currency float, though experts call it a pipe dream (at least for the time being as of August 2025).

Furthermore, digital currencies like Bitcoin or China’s digital yuan, add pressure to the dollar; offering ways to bypass dollar-based systems in this changing age of the global economy. Politicians and economists alike rage about American sanctions driving BRICS to rebel, with analysts warning of a “dollar crash” if trust fades. Recent 2025 events tied to war and social disorder pile on the heat too.

American-based credit rating company Moody’s downgraded the US credit rating in early 2025, citing ballooning deficits, while new US tariffs—some as high as 20%—sparked trade spats with China and the EU, hinting at a less open global market. Gold reserves climbed to 23% of global holdings, fueled by price surges, as some nations hedge against dollar risks. Yet the dollar’s still got some serious muscle: the US economy (still 24% of global GDP) dwarfs rivals, and its financial markets are unmatched for depth and trust as of yet.

Forged in Chaos, Seasoned with Power

No currency—yuan, euro, or crypto—matches the US dollar’s liquidity or stability for all these years. Though the BRICS nations combined push is real, their economies are still too tangled with the dollar to break free fast. After all, the American greenback’s a seasoned survivor; forged in chaos and holding firm grip on the global economy. Will the US dollar keep its crown? Only time will tell, but one thing’s for sure: the USD is one hell of a fighter.

Header Image: Hundred dollar bills featuring one of the USA’s iconic Founding Fathers: Benjamin Franklin. By FFCU. Source: CC BY-SA 2.0.

References:

- World Bank Group. Bretton Woods and the Birth of the World Bank. World Bank Archives, www.worldbank.org/en/archive/history/exhibits/Bretton-Woods-and-the-Birth-of-the-World-Bank. Accessed 19 Aug. 2025.

- Dsouza, Vinod. “Death of the US Dollar Has Begun With BRICS Rebellion, Says Forecaster.” Watcher Guru, 11 Aug. 2025, watcher.guru/news/death-of-dollar-has-begun-brics-rebellion-us-forecaster.